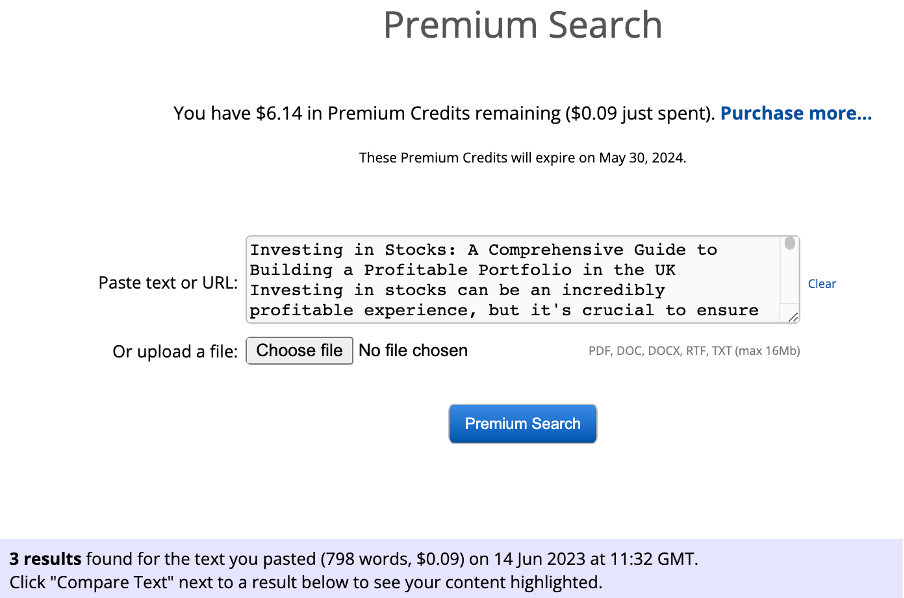

Investing in Stocks: A Comprehensive Guide to Building a Profitable Portfolio in the UK

Building a Profitable Portfolio in the UK

Investing in stocks can be an incredibly profitable experience, but it’s crucial to ensure that you’re making wise investments and developing a portfolio that meets your long-term financial goals. In this comprehensive guide, we’ll discuss the key steps to take when investing in stocks to build up a successful and sustainable portfolio. We’ll also look at some of the latest trends in stock trading, such as crowdfunding platforms and electronic trading, so you can make informed decisions about how best to invest your money.

Whether you’re just getting started or are already well-versed in stock market investment strategies, our guide will help equip you with the knowledge needed to become a savvy investor.

What Are Stocks?

Stocks are a vital component of any investor’s portfolio. Also called equities or shares, stocks represent ownership in a company. When an individual buys a stock, they buy a small piece of the company. Stocks are traded on stock exchanges, and prices fluctuate based on supply and demand.

The value of a stock can rise or fall depending on how well the company performs. Owning stocks can be a lucrative investment, but it’s essential to understand the risks involved. Investors must pay attention to market trends and economic indicators to make informed decisions about buying and selling stocks.

What Is Stock Trading?

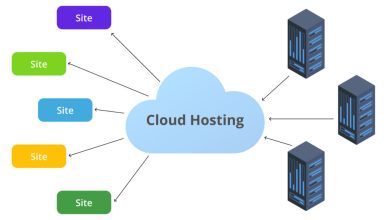

Stock trading, also known as online stock trading or equity trading, is the buying and selling of stocks. Traders can buy and sell stocks through a stockbroker who will execute the trades. There are different ways to trade stocks, including electronic trading, investing in funds and using crowdfunding platforms.

Electronic trading uses automated systems to place orders on exchanges at specific times while investing in funds involves pooling money with other investors for collective gains. Crowdfunding platforms enable traders to access high-risk investments that may not be available through traditional channels. Trading stocks online can be a great way to build up a portfolio, but ensuring you have the necessary knowledge and experience before investing is crucial.

Create an Investment Plan With Stocks

Creating an investment plan is a critical step in building a successful portfolio. When investing in stocks, it’s essential to have a strategy that reflects your long-term goals and financial situation. Consider factors such as the amount of money you want to invest, how long you want to hold onto the stocks and what type of stocks you want to buy. It’s also important to diversify your investments across different sectors and industries. It will help reduce losses if one industry or sector experiences an unexpected downturn.

Additionally, consider setting aside some funds for short-term investments to take advantage of sudden market conditions changes. Finally, be sure to keep track of all your investments to stay up to date on news and market conditions. It will help you decide when to buy or sell your stocks.

Understand Risk and Volatility

Investing in stocks can be profitable, but it’s essential to understand the risks involved. Stocks are subject to market fluctuations, and prices can rise and fall unpredictably. It means that stock trading carries a high risk, particularly for those with limited experience or knowledge of the markets.

It’s also vital to consider volatility when investing in stocks. Volatility measures how much an asset’s price fluctuates over time. The higher the volatility, the greater the risk associated with the investment. High-volatility stocks tend to be more unpredictable than low-volatility stocks, so understanding volatility is vital to wise investments.

Choose the Right Brokerage Firm

Choosing the right brokerage firm is essential for successful stock trading. Your broker will be responsible for executing your trades, so you want to choose a reputable and reliable company. Look for brokers that offer competitive fees, low commissions and user-friendly platforms.

It’s also essential to research the customer service available from each broker since this can impact your investments’ success. Additionally, if you’re new to investing in stocks, look for companies that provide educational resources and guidance, such as online tutorials or seminars. Finally, consider researching additional brokerage services, such as tax advice and portfolio monitoring.

Research Your Investment Options

Researching the stocks you want to buy is also essential to becoming a successful investor. Before investing, understand the company’s financials and market conditions. Look at earnings and cash flow statements to determine whether the stock is worth buying. Additionally, consider tracking news developments and economic indicators affecting the stock price.

It’s also helpful to research other investors’ opinions on stocks before making any decisions. Finally, take the time to understand the risks associated with each investment so that you can make informed decisions about when to buy or sell your stocks.